Surely, by now you've heard all about the Cassidy-Graham Amendment to repeal the Affordable Care Act (known to you Republicans as Obamacare).

David Dayen, a contributor to The Intercept, Salon, the Fiscal Time, the New Republic, as well as several others, and author of, "Chain of Title," the book documenting the three Americans who uncovered Wall Street's foreclosure fraud, wrote an excellent piece contrasting the GOP's approach to this amendment and how it differs from their position on punishing the successful when it comes to taxing the rich.

In, "The Shocking Dishonesty of the GOP's Latest Repeal Push, Dayen argues on behalf of the amendment:

"Senators Bill Cassidy and Lindsey Graham have been selling the proposal, which conflicts with a fundamental conservative tenet: that egalitarian policies “punish success.”"What Dayen means is the GOP basically uses contradictory strategies to protect the rich from tax increases.

"They respond that all Americans have the same opportunities to obtain wealth (they don’t) and we shouldn’t punish those who managed to thrive. It’s simply un-American to penalize those who put in hard work and play by the rules."In reference to healthcare spending for the states, Cassidy told healthcare reporters, "These funds are quite unequally distributed. Where you live should not determine how healthy you are."

Graham doubled down when he said this on the Senate floor: "I like Massachusetts, Maryland, New York, and California, but I don’t like them that much to give them the money that the rest of us should get!"

The problem with their statements and approach are the fact that those funds are available to all states, not just the Marylands, New Yorks and Californias.

Dayen wrote:

"The states listed above obtained a disproportionate share of federal health care dollars because they tried. Operating under the same terms available to every other state, they expanded the Medicaid program and did their best to sign up the uninsured for both Medicaid and the Obamacare exchanges. Instead of denying the poor coverage, they took the bargain offered under the ACA to cover all of the costs of Medicaid expansion initially and around 90 percent over time. Instead of making it more difficult to navigate the individual market, or consign people to the federal exchange, these states built their own websites and worked to promote and assist with getting covered."Like the rich, so often defended by the GOP, those states tried. They worked hard for their citizens.

That's the argument the GOP makes when protecting the rich from paying their fair share. All of a sudden, protecting those who try no longer is a tenet of the GOP.

The most interesting tidbits gleaned from Dayen's piece actually come from data he sourced from other publications.

It's ironic to note that while two Republican senators are doing their best to take away the healthcare from millions of Americans nationwide, it's their states that TAKE the most from the government in other areas.

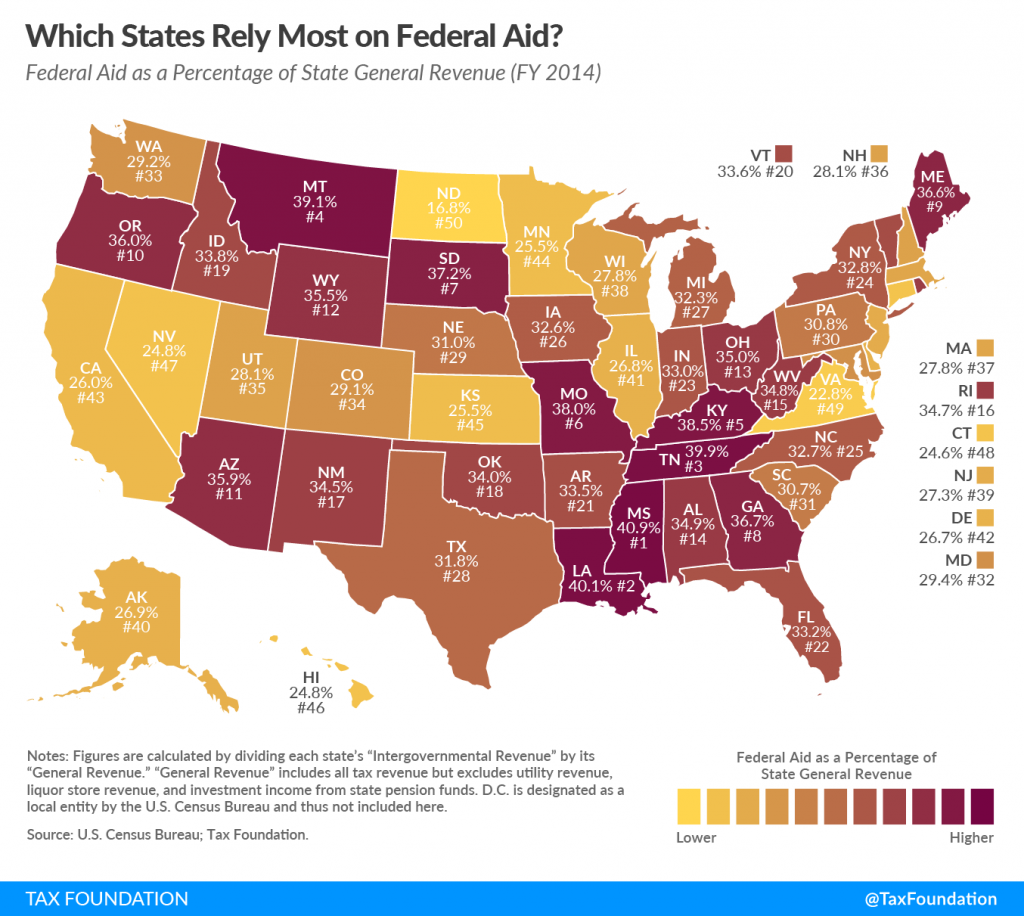

Take a look at the chart below:

Each state generates a significant portion of its revenue through state taxes. But, each state also receives federal funds.

The chart above indicates how much of each state's revenue is derived from the federal government.

"The top recipient of federal aid in FY 2014 was Mississippi, which relied on federal assistance for 40.9 percent of its revenue. Other states heavily reliant on federal assistance include Louisiana (40.1 percent), Tennessee (39.9 percent), Montana (39.1 percent), and Kentucky (38.5 percent)."What do those states above have in common?

Overlay an election map from November 2016 and you might reveal the answer.

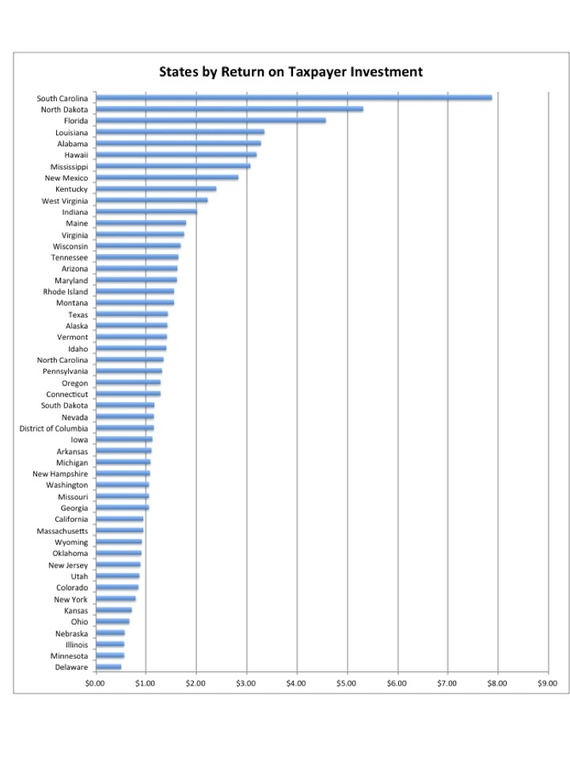

Now, here's another chart, this one provides the return on its investment each state receives.

What the map above shows is that the most “dependent states,” as measured by the composite score, are Mississippi and New Mexico, each of which gets back about $3 in federal spending for every dollar they send to the federal treasury in taxes. Alabama and Louisiana are close behind.

If you look only at the first measure—how much the federal government spends per person in each state compared with the amount its citizens pay in federal income taxes—other states stand out, particularly South Carolina: The Palmetto State receives $7.87 back from Washington for every $1 its citizens pay in federal tax.

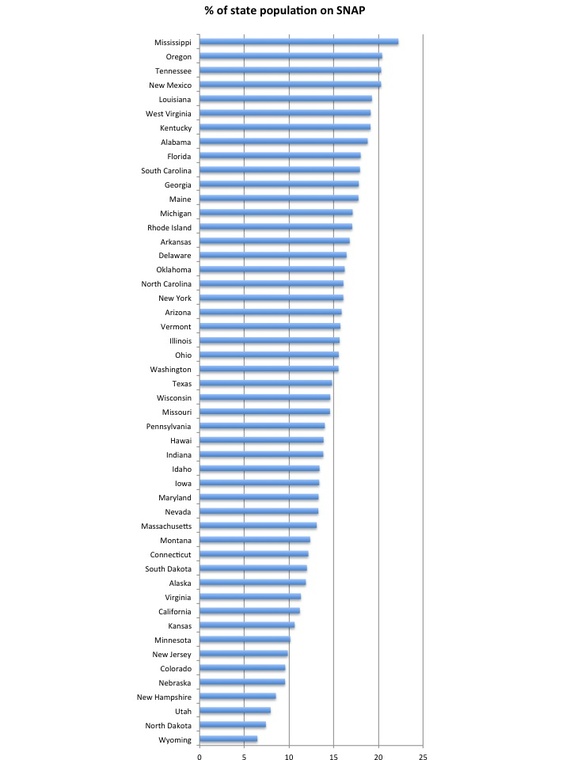

And finally, one more chart. This one shows the disparity between states receiving SNAP (food stamps) benefits:On the other side of this group, folks in 14 states, including Delaware, Minnesota, Illinois, Nebraska, and Ohio, get back less than $1 for each $1 they spend in taxes.

It’s not just that some states are getting way more in return for their federal tax dollars, but the disproportionate amount of federal aid that some states receive allows them to keep their own taxes artificially low

The point here is if Cassidy and Graham really were concerned with the unequal distribution of federal spending, they'd target these other programs just as diligently.

Instead, they're going after the one affectionately known as "Obamacare." They refused to expand Medicaid. They refused to help the bill succeed. For eight years they have targeted it and failed because even their own constituents benefit from the program.

I really hope they succeed in repealing the Affordable Care Act. Their voters deserve it. The rest of us are just collateral damage.

No comments:

Post a Comment